For your company to get noticed by potential buyers, you have to play up what makes you unique. But unless you listen to what competitors say, you risk trying to pass off the same old thing as your point of differentiation.

Imagine getting quotes on windows for your house. You have a stack of manufacturer brochures in front of you, and every one brags about a warranty.

You ask the next window salesman in line why you should buy from him. He smugly says, “We’re not like those other guys that don’t put their money where their mouth is. We have a warranty!”

To save you from this embarrassment, and help you stand out with messaging that’s truly unique, I’m going to teach you to do a competitive marketing analysis.

What is a competitive marketing analysis (and why should I do one)?

In a competitive marketing analysis, you examine the marketing channels and messages in use by your top competitors. It’s an important part of building your messaging strategy because it’s impossible to stand out by sharing the same messages as everyone else.

Your goal in this analysis is to find messaging gaps – positions in the market no one is effectively filling.

I find it most useful to put the competitor analysis in the middle of my research phase – in between customer research, where I like to start, and positioning a business, which puts the insights from customer research and competitor analysis into action.

How do I do a competitive marketing analysis?

Analyzing your competitors’ marketing to find where you fit in isn’t as hard as it sounds. You can do it in four steps with minimal tools:

- Identify your top competitors

- Compare your offerings

- Examine competitor messaging

- Identify gaps you could fill

Step 1: Identify your competitors

Make no mistake: you have competitors. Even if you have a completely unique, first-of-its-kind solution that no one else has ever dreamed of before – you have competitors.

When most people think of competition, they think of direct competitors. These are businesses that do essentially the same thing you do.

Target is a direct competitor of Walmart (both discount general merchandise retailers).

Nike is a direct competitor of Adidas (both shoe makers).

Indirect competitors solve the same problems you do. They just do it in a different way. For example, Air BnB isn’t a hotel, but it competes with hotels for the same customers.

Hello Fresh is an indirect competitor of restaurants (both solve the problem of “I don’t know what to make for dinner”).

SEO agencies are indirect competitors of ad agencies (both solve the problem of bringing traffic to a website).

The indirect competitor that everybody faces is the status quo.

You are always competing against the way your customer deals with the problem now – including just living with it and doing nothing.

This is the step that often overwhelms people. After all, odds are there are hundreds, even thousands, of businesses doing what you do.

Make it manageable by focusing on just 2 to 4 top competitors, plus the status quo. That should be enough to find your unique edge.

4 Ways to Identify Top Competitors

- Search online for your product or service. This is a quick-n-dirty way to find the industry leaders.If I Google “streaming services,” the first non-sponsored posts are all listicles of popular services. If I Google something a little more niche, like “business coach,” the first non-sponsored pages are all written by coaching services.

The businesses surfaced by search engines and third-party lists are generally at the top of their industry.

2. Use a market research tool. Tools like Crunchbase offer a ton of useful data – including top competitors.

3. Analyze your opportunities lost. Look over your data on sales leads that didn’t close. What reasons did they give? What alternative were they going to try instead?

4. Talk to your customers. While you’re looking at your CRM, also reach out to some leads who did close. What other alternatives did they consider before buying from you?

Step 2: Compare your offerings

Now that you know who you’re up against, take a look at what they offer. Make a list with three columns:

- What They Offer (That I Don’t)

- What We Both Offer

- What I Offer (That They Don’t)

Your first pass at these lists will probably just come from a look at your competitors’ websites. But don’t stop there.

“What I offer” isn’t limited to products and services. It can also include the way you do business.

For example, Chewy offers pet supplies. But they’re famous for sending sympathy cards to customers when a pet dies. Il Makiage offers makeup. But they’re famous for their “try before you buy” return policy.

To find these hidden differentiators, look at competitors’ social media accounts and customer review sites. You can also try a tool like Buzzsumo to see if there are public conversations going on around your top competition.

Step 3: Examine their messaging

While you’re poking around your competitors’ websites, social media accounts, and ad campaigns, notice the messages they’re using.

What offers or benefits are emphasized? Which customer problems are center stage? How are they establishing credibility?

I once had a client who was really proud of their 20 years in the industry and led a lot of their messaging with it. Unfortunately, their top three competitors had all been in business longer – so as a credibility statistic, it wasn’t super impressive.

Make note of how your competitors position themselves in the market. Common positions you might see include:

- Most experienced

- Most responsive

- Highest quality

Unless you can absolutely blow away the competition from their chosen position, leave those occupied positions alone. It’s a lot easier to slide into an open spot than go head-to-head for a position someone else has already claimed.

Step 4: Find the gaps

Let’s review. At this point in the process, you know:

- Who your top competitors are

- How people who buy from neither you nor your competitors are solving their problem (the status quo)

- What you offer that the top competitors do not

- What market positions are already taken

Now: what’s left?

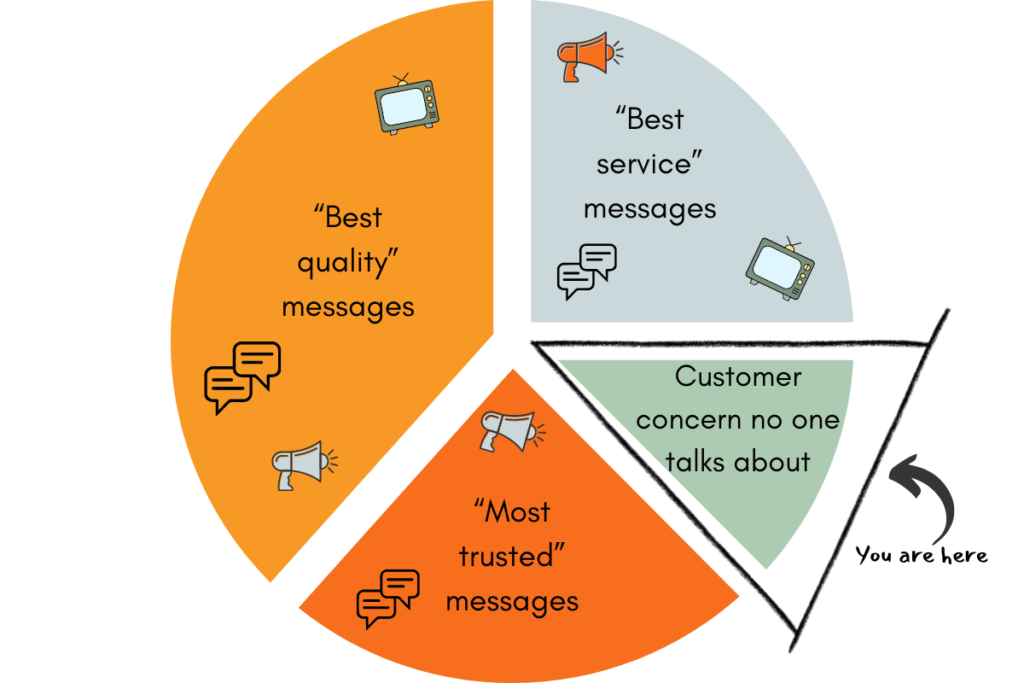

This last step uses the process of elimination. By analyzing your competition, you see where the herd is headed – so you can zig where they zag.

What to do with your results

OK, you did the things, you finished your analysis – now what?

Now you combine those insights with your customer research to identify gaps in the market that you could fill. One of those will become your market position. Then you use that position to set a direction for your messaging strategy.

Here’s what you’ll want to look for when choosing the gap you will fill:

- What is unique to your business – that competitors don’t, won’t, or can’t say about themselves?

- What is really important to customers – that competitors aren’t talking about?

- Can you connect your differentiators to what customers care about?

- Do the positions you’re considering align with your business goals and values?

- Is positioning your business this way feasible?

- What are the potential short-term and long-term impacts of adopting this position?

Tools to dig deeper

You can do a competitive analysis completely for free (minus the time cost) using a search engine, social media sites, and maybe the free version of an analytics tool.

If you really want to dig deep, or if this is a tactic you plan to employ often, you might want to stock your toolbox with one of these high-quality competitive analysis tools.

(Note: I am not an affiliate for any of these tools and receive no incentives or compensation for listing them.)

- SEMRush – It’s most famous as an SEO tool, but SEMRush also has powerful market research capabilities, including traffic analytics, organic research, social media tracking, and advertising research.

- Spyfu – I’m a longtime fan of the free version of this tool, which includes competitor site analysis, pay-per-click analysis, and SEO tracking.

- Similarweb – Keep running track of your competitors’ SEO, pay-per-click, advertising, and other marketing activities with this tool.

Avoid these analysis mistakes

Make the most out of your competitive marketing analysis by keeping an eye out for common trip hazards:

- Overlooking internal attributes. Don’t get so caught up in the competition you forget to analyze your own strengths and weaknesses. And be honest – it can be really tempting to think you’re better at your signature offering than they are. Look at your business and your competitors through a customer’s eyes.

- Ignoring market trends. A marketing analysis is focused on what competitors are doing now. But we’re not marketing in a time vacuum.

Notice if there has been a shift in competitor messaging or target audience and think about what that might mean for your own messaging. And be aware of what is happening throughout the industry and what trends are likely coming around the bend.

For example, positioning yourself a few years ago as the “AI-powered” solution could have been really effective. As AI is incorporated into every facet of business – and people are starting to push back against it – it doesn’t carry the same panache it once did.

- Failing to act. A personal pet peeve: businesses that put lots of work into research and planning, then carry on as they’ve always done.

Are you kidding me? Just don’t. Once you have these insights, put them into action.

Why do a competitive marketing analysis?

I get it. This can sound like a lot of work. It seems easier to just look at the ads of your top competitor and either

a) point out where they’re wrong or

b) argue the same point better.

Problem is, that’s not going to get you the attention – or, more important, the action – of your audience.

A competitive marketing analysis helps your business to stand out, to act fast on opportunities, and to act early on potential threats.

Stand out. You cannot stand out in a sea of competitors if you look and sound exactly like them. You have to differentiate yourself. And the only way to do that is to know what humdrum messages to avoid.

Grab opportunities. Loom could be just another video recorder. By combining customer research and competitive gap analysis, they saw the position no one else was taking: an asynchronous communication tool for remote teams at a time distributed work groups were becoming the norm.

Detect threats. Are your competitors all suddenly shifting away from a position? This could be an opportunity to swoop in, or it could be a warning of impending industry flux. Are they moving their messaging in the direction of something you offer that they don’t? They could be getting ready to launch a new offering you should be ready for.

Making competitive marketing analysis part of your marketing strategy

A solid marketing strategy is built on a firm foundation of data – data about your company, your customers, your market, and your competitors.

For most businesses, a competitive marketing analysis can be done about once a year. Most years, it will not lead to a whole new position; it will just give you information to strengthen your hold on the position you have. It can also give you a heads-up to potential threats or opportunities in the market.

This is in contrast to customer research. Ideally, that should be performed at least twice a year if not every quarter. Businesses in fast-moving industries might find it easier to establish a workflow that keeps a constant ear on customer voices.

Company research, customer research, and competitive market analysis are the first three activities I tackle when I’m building a no-fuss content strategy. They’re foundational pieces that support everything I build on top of them: messaging, content pillars, channel selections, key performance indicators, and workflows that fit content creation and distribution painlessly into the time a marketing team has available.

To talk about building a data-backed, no-fuss content strategy for your business, schedule a discovery call. To pick my brain for a few specific questions, schedule a one-hour Strategy Quick Start.